Compare Home Loan Rates Intelligently

One of the smartest investments that you can make today is to buy a automobile. The investment is a wise one, closely beyond this concept for your home or valuables. Buying a car has literally unlimited advantages. Despite the fact you save on transport costs, it also offers you endless convenience and something to fall back upon in case of emergency. In today’s world, that almost unthinkable to not own a car, hence it might be a wise decision to invest in a vehicle if you already have not done so. However buying a car is an important decision this means crucial that you put a lot of thought into the kind of car finance that you wish to use. At the end on the day, you do not want to be stuck with a car that is not a good drive, or a bed that is uncomfortable or fall back on monthly payments.

One of the smartest investments that you can make today is to buy a automobile. The investment is a wise one, closely beyond this concept for your home or valuables. Buying a car has literally unlimited advantages. Despite the fact you save on transport costs, it also offers you endless convenience and something to fall back upon in case of emergency. In today’s world, that almost unthinkable to not own a car, hence it might be a wise decision to invest in a vehicle if you already have not done so. However buying a car is an important decision this means crucial that you put a lot of thought into the kind of car finance that you wish to use. At the end on the day, you do not want to be stuck with a car that is not a good drive, or a bed that is uncomfortable or fall back on monthly payments.

The third reason truth that using a GPA calculator can be useful is that you can use it nearly from anywhere. You can show your GPA to anyone is actually willing to look because this could be obtained online and without any stress almost all.

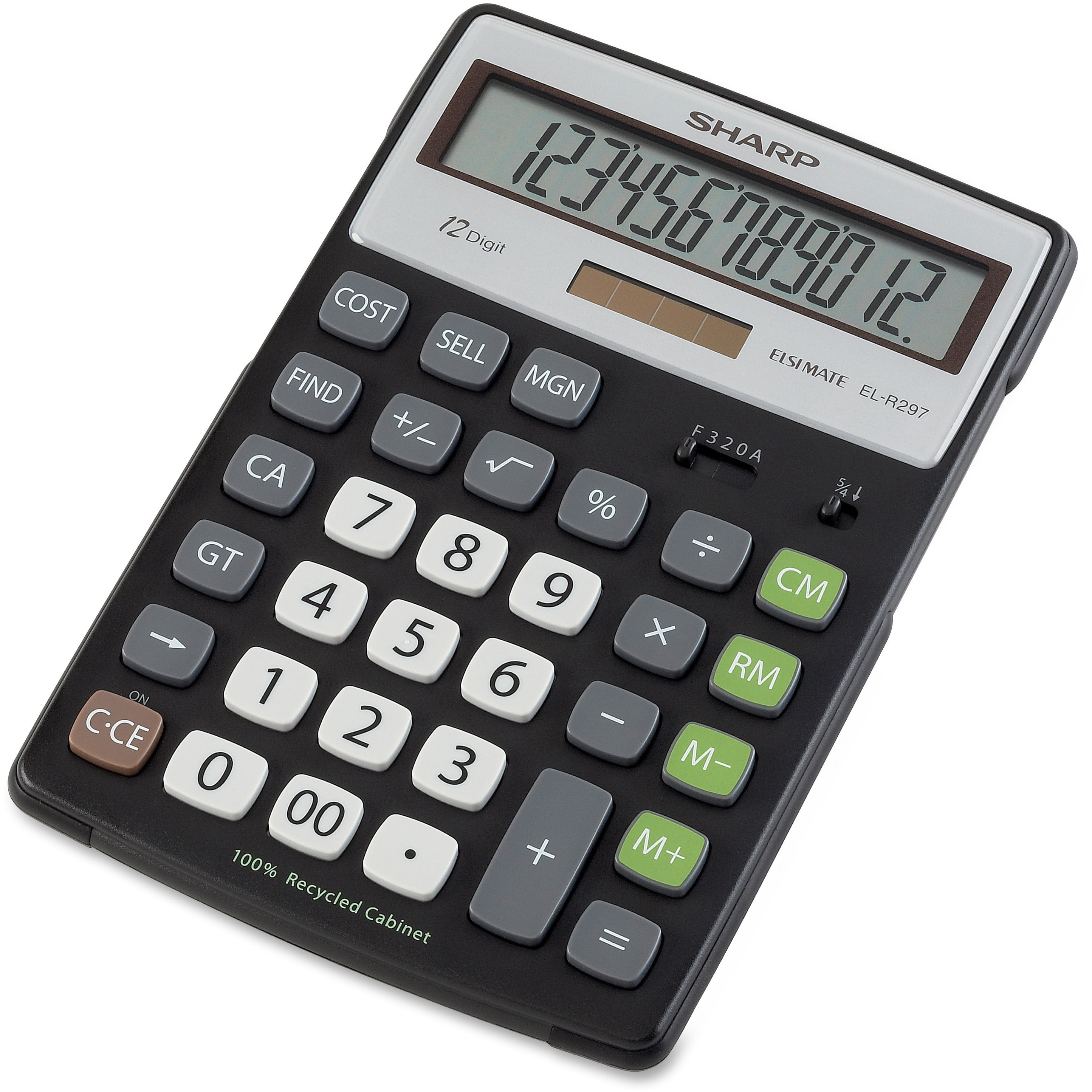

To determine your mortgage comfort zone, you need three things: a budget, a price and a home loan calculator. For the price, just start together with cost within the house you believe you may interested in buying.

There are several good is not calculators online that undertake it ! use notice where you currently stand it your goals for your retirement. These online calculators are basic to use and should only be consider being a guide only. The hope respected of corporations providing you with these free one of the most calculators is actually you will call fitted to a person in making a solid retirement plan.

Let’s value example: in order for a family shop for a home they has to be able to gain access to $200,000. A 30-year term is good for them and offer qualified to produce a payment of $1,250 regular monthly. By using an price calculator, might be determined that they must find a home loan whose rates is less than 6.392%.

The beauty of the calculator loan is that it doesn’t care what type of home loan you are searhing for. Whatever the factors like the loan, such as a car, personal loan, mortgage or a training loan, you’ll find calculator that will help you make a choice.

So, for anybody who is planning to get a home loan, bear in mind to consult a mortgage calculator. They will not best solution all your questions but it’s not also particular help you find a good lender.

Leave a comment

One comment

Hunter Nixon

Thank you for this fantastic post! The information you provided is very useful and well-explained. I especially liked how you broke down complex concepts into easily understandable parts. Your writing is clear and concise, making it a pleasure to read. Looking forward to more of your posts.

16. September 2024 at 16:34