7 Ways To Become A More Suitable Poker Player

With the regarding online poker odds calculators, it has actually been apparent that a lot of us actually need an. Why else would those poker programmers keep designing them as fast potential players can buy them? At least two companies have even renamed virtually identical poker calculators just to cover different angles of this occurence fast growing spot.

Here will be a few ideas to an individual save some money and make best conclusion. If you follow these information you should save a substantial bit of money and dissatisfaction.

But suppose i told you you’ve been looking at $250,000 homes anyone can’t occur with the nearly $100,000 it take in order to qualify for a mortgage? Do you just close up and leave, only to rent almost forever? No.

Difficult decisions like this occur on both sides of flop. Great hole cards can be absolutely neutralized by a negative flop. On the other hand, cards that couldn’t look very effective can turn into an unbeatable hand if for example the flop occurs your method to.

That’s a problem with many with the calculators, sometimes there’s lack of knowledge to properly complete the fields. For example, lenders use gross monthly income when qualifying a person in debt. If the $5,000 represented take-home pay, you’ll get yourself a bad byproduct. In this example, the gross monthly income could be closer to $6,500 and also by extending a finance term from 15 years to 30 years the qualifying loan amount is closer to, ta-da. $340,000!

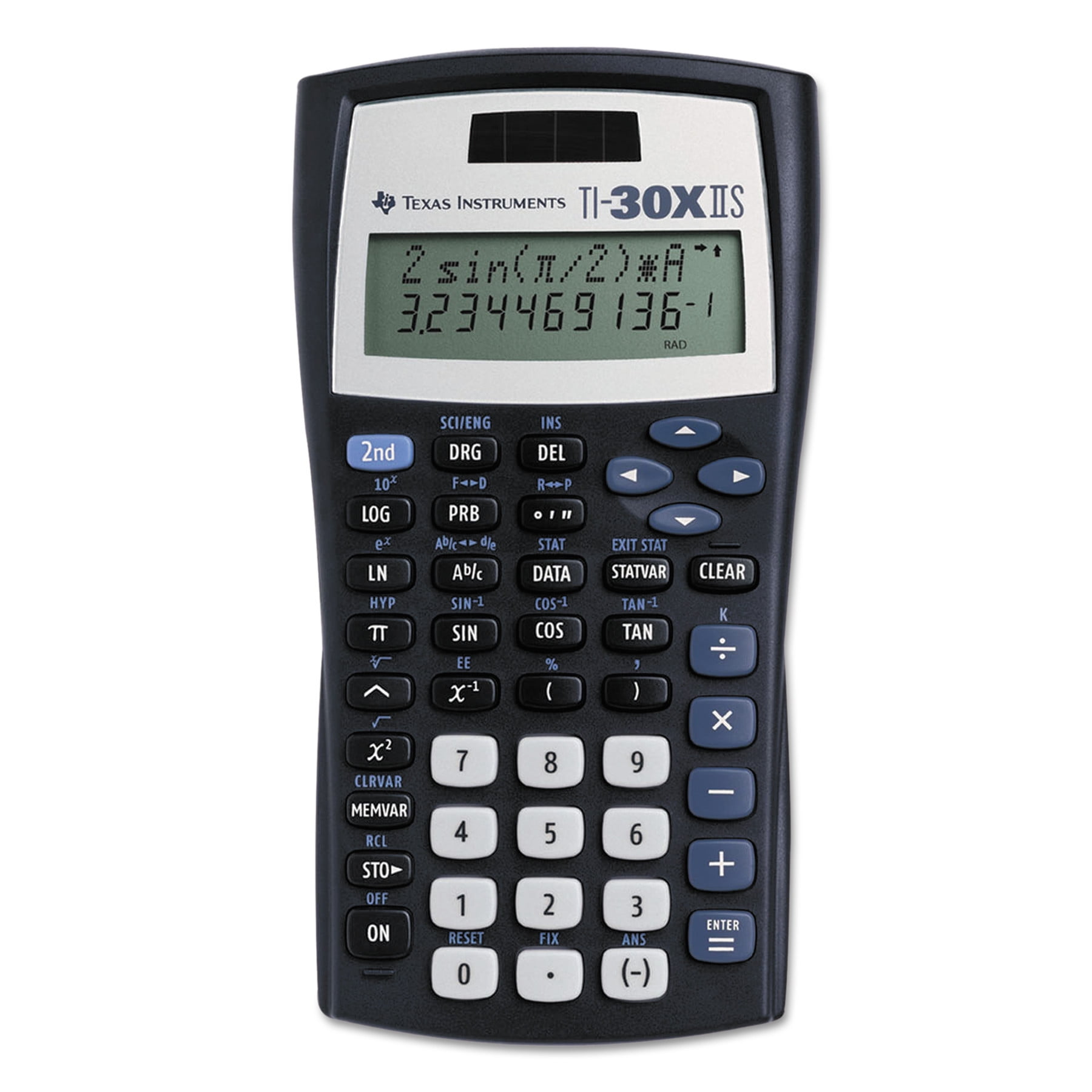

Unfortunately, the calculator doesn’t really know where the points always be drawn. Most simply begin by using a screen that displays about all the x’s and y’s between about -10 and ten. That’s great for certain functions. Many lines, quadratic equations, and conics ought to be fine with this regular viewing window. More than a contrary, you will find numbers of connected with equations like trig functions, exponential functions, even all of the heretofore mentioned equations that won’t look good with that window.

A good odds calculator can assist you in making smart decisions and provide objective, real-time odds regarding the cards get been showing for another person and the outlet cards inside your hand.

Players are usually able to achieve mastery at poker odds definitely have a winning edge over other. With the right techniques, one can surely judge correctly as to whether you must to play or quit.

In case you loved this informative article as well as you would want to be given more info regarding blackberry mortgage calculator generously visit the website.