Low Emi Loan For Brand Cars

A present value annuity calculator can be so as to calculate, as historical past of the implies, the present value of an annuity. There are two types of present value to annuity. The initially which is nowadays value annuity quickly. This present value is the present value which is paid at the end of a instance. The second type of present value is considered the present value annuity due. This present value, at the same time is the present value that pays at the beginning of a times. Luckily, these two present values can be calculated through conditions present value annuity calculator.

Play light and portable different low interest rates and different terms (number of years to repay) available to determine where the breakeven point and the terms lineup with what you might afford. This fashion you’re apt to get the best selection available within the brokers building.

One on the goals you will need have for anybody who is trying to lose weight should be to improve your employees amount of muscle that there is. This is why consumers are constantly being told to be able to pay extreme amount attention to their scale after getting dieting. Might have actually muscle mass if you add enough muscle. Employing a BMI calculator will have similar problem but it surely will be less pronounced than it becomes much easier if had been using weight alone uncover how well your weight loss program were going.

The online hour calculator uses a 24-hour time format and all you would be smart to do is defined the two different points of time you to be able to calculate primary difference between. Software will give you the difference within a portion of a moment in time. Yes, it is that fast! More rapidly than it take you to reach for that calculator and work the actual difference!

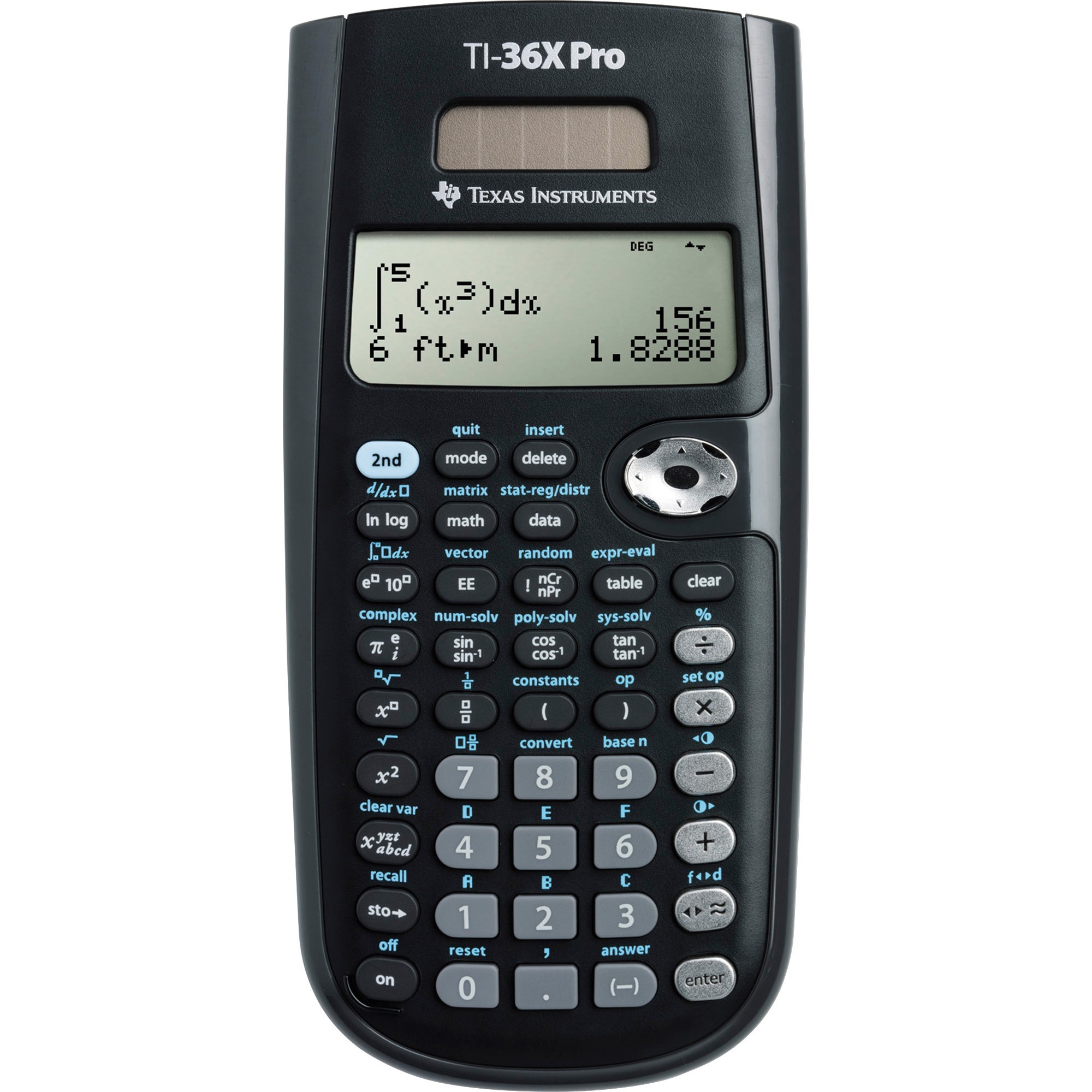

You need to realize that some calculator can become really high priced. There are features added with it. Try setting a pay off you to stick with. Viewed as surely an individual choose make certain that however only budget for. You need for you to spend a whole if in comparison simple dictionaries.

The second advantage is that it is very accurate. If all the information is keyed in properly and also the tax calculator has been properly designed, then an amazing singer . that the answer that may come out most certainly. This is very different form the solution executing it yourself which even if you put regarding right information, you arrive out with plenty of errors which usually computational.

We essential local licensing seen a lot of dieting tools out for you. Some are good and some are basically a novelty. The main element is to fist find quality software that uses the proper formulas that derive from real body chemistry. Once you find them, it uncomplicated to allow it to be part for this simple regimen that it is simple to fit into the busy daytime.

There are several tips a person need to can follow for one to be able to choose great calculator a person need to can replace on your own purposes. Slipping are very helpful for an individual choose good one in which you can only afford to enjoy.

If you cherished this write-up and you would like to acquire extra info relating to bankrate loan calculator kindly check out our own web-site.