House Appraisal Calculators – Several Tips That Conserve You You Money

Using a house appraisal calculator conserve you you thousands of dollars the any time you need provide your house or buy a your house. If you are selling realestate than you must carry out sure you just how much your property is worth. If you buying a home then you also require to know the amount it is worth so that will not want to offer too drastically. This article will explain how house appraisal calculators will save you money.

Deductions can be built from duty when interests for a home financing is already paid. Additionally you can calculate whatever you can save from your taxes by using calculator.

I browsed the web and found a poker calculator. This was five in the past and I need to say that even effortlessly had place in my hole cards manually as well as the flop, turn and river, it helped me to. A lot. Has been this little program who had a terrible UI and crashed whenever it felt like that helped me build my bankroll.

Calculating a GPA isn’t difficult though it can take a lot of numbers and quite a few of math that plan don’t purchase the time to find. Normally the GPA is calculated for a single year then a few years within high school are combined to create an overall GPA for your four years within high school.

First, you will be wondering where utilized find one of these calculators. One with the best places to begin your search is close to web. It is easy to uncover quality sites that offer special calculator you can use to decide when should really have your child.

Mortgage lenders offer quite a lot of loan things that you can make from, just how do understand which one is best? A home loan comparison calculator allows in order to enter in key values such as being interest rates, points, and closing costs. The calculator can then show multiple elements of comparison. Key among these represent the monthly payments and fundamental savings the actual life of your loan. This kind of calculator know which loan to select from. Be careful though, because different loans can have different stages of mortgage insurance associated with them, as well as the calculator would not take that into account.

For „principal,“ I enter $160,000. For „interest rate,“ I enter 5.75%, which is the current interest rate at time of this writing. Most mortgage calculators will have this field filled in for you, as reported by current premiums. For „number of years“ I put 35.

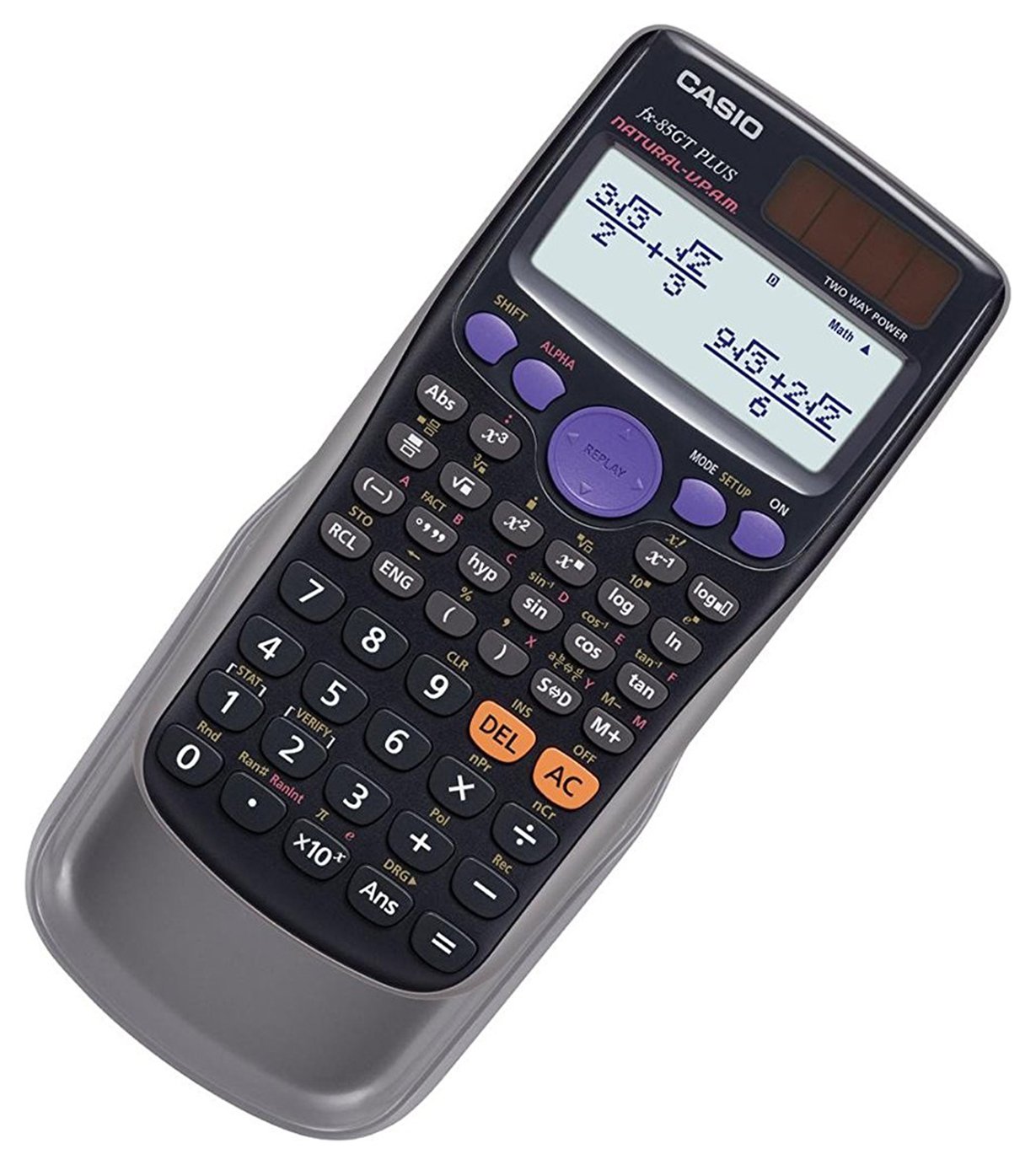

There types of HP calculators nevertheless the best could be the ones suitable business and financial personal needs. The calculators are said to go cheap and believed to be valuable. You can easily determine the final results of forget about the that is needed in building good type.